Our portfolios are designed to suit yourinvestment needs

To help ensure our clients are properly invested based upon the goals and objectives of their financial plans, we’ve committed ourselves to meeting the challenges of an ever-changing marketplace and economic landscape. That’s why you’ll find investment portfolios that we carefully construct and manage ourselves at the heart of the investment services we provide for our clients.

We offer a total of six portfolio models: three allocation models and three fixed strategy models, one of which is completely customizable for clients with specific requirements. Determining the best model choice for a client depends on investment objective, time horizon, risk tolerance, income requirements, past experience and outlook – information that is carefully detailed during the financial planning process.

Allocation models

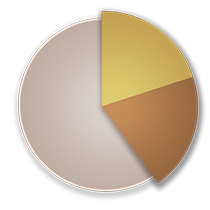

Conservative Model

The primary objective is to generate income and minimize principal volatility over the intermediate term. This model is suitable for investors with large portfolios, less risk tolerance, or a shorter time frame. "The model will invest 40% – 60% of assets in dividend paying equities and 40% – 60% in fixed income and cash alternatives.

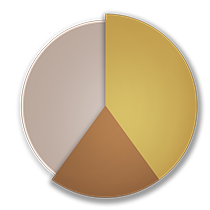

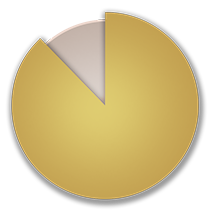

Balanced Model

This model seeks longer-term total return. Interest, dividends and capital appreciation will have equal importance in the performance of the model over the intermediate to long term. Investors who seek higher long-term returns while attempting to manage volatility may find this model the most appropriate. This model will invest 40% – 60% of assets in equities and 40% – 60% in fixed income and cash alternatives.

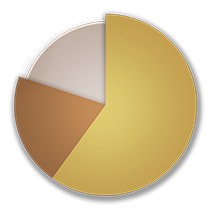

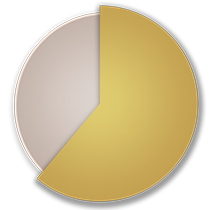

Growth Model

Investing with a focus on long-term capital appreciation is the objective of this model. It also attempts to manage risk by owning higher yielding dividend stocks and a fixed income allocation. Investors with a longer time frame and higher risk tolerance will find this model may provide the highest potential returns over a full market cycle. This model will invest 60% – 80% of assets in equities and 20% – 40% in fixed income and cash alternatives.

Fixed strategy models

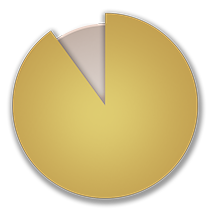

Capital Appreciation Model

This model invests in companies that have demonstrated higher than average revenue, earnings and dividend growth. The core holdings are selected using a top down approach and fundamental analysis. In an effort to enhance performance, we also use a bottom up approach to add peripheral holdings that have higher returns on equity and capital. Disciplined buy and sell targets are used to remove the emotional component of the investment decision. In addition to individual equities, the strategy may also own mutual funds or exchange traded funds to satisfy equity allocations. During different market environments and economic conditions we may overweight or underweight the different asset classes and sectors of the market.

Equity Income Model

Investing in stocks that generate significant dividend income while still allowing for capital appreciation is the focus of this model. Historically, dividends have made up a meaningful part of an investor’s total return. This strategy concentrates on companies that pay above average dividends with the potential for growing the dividends in the future. Selection of the portfolio begins with a broad universe of equities that we screen for dividend yield, dividend growth, and market capitalization. We then look at individual company fundamentals including valuation, price to earnings ratio, revenue growth, cash flow and debt. For final determination, we balance the holdings in the portfolio to track the sector weightings of the broad market and the economy.

Custom Model

For clients whose investment needs require special consideration – such as those who hold a large position of stocks with a low cost basis – we can build a custom model to specific requirements. Since we provide discretionary portfolio management, we will work with you to develop an investment policy that matches your objectives and tolerance for risk. This will free you from the sometimes day-to-day communications that are a part of investing, and provide our team the flexibility to manage the asset allocation of your portfolio as well as tax consequences of trading.

Diversification and asset allocation do not ensure a profit or protect against a loss. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Dividends are not guaranteed and must be authorized by the company’s board of directors.

Securities offered through Raymond James Financial Services, Inc. Member FINRA / SIPC. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. Chapman & Cardwell Capital Management is not a registered broker/dealer, nor is it affiliated with Raymond James Financial Services.

Raymond James financial advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Therefore, a response to a request for information may be delayed. Please note that not all of the investments and services mentioned are available in every state. Investors outside of the United States are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this site. Contact your local Raymond James office for information and availability. Links are being provided for informational purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. | Legal Disclosures | Privacy Policy

© Chapman & Cardwell Capital Management. All Rights Reserved.